The year gone by was a tumultuous one for Europe’s relations with China, to say the least.

With the Comprehensive Agreement on Investment (CAI) put on hold, a round of sanctions imposed on China for its treatment of Uyghurs in Xinjiang, and several policy initiatives such as the Anti-Coercion Instrument (ACI) announced, Brussels has clearly been busy keeping its guard up for long-term competition with a more assertive China.

Still, the bloc is apparently not keen on choosing a US-style path of outright confrontation. Indeed, even as consummate China-defender Angela Merkel leaves her post in Berlin, the bloc’s somewhat ambivalent policy remains largely intact.

However, to the east of Berlin, in the countries of Central and Eastern Europe (CEE), 2021 was perhaps the fever pitch for strained relations in this century. Several national capitals decided to redesign their official policies towards China, albeit to differing extents, which caused waves not only in the region, but also globally.

2021’s Twists and Turns

The most emblematic case of this banner year for coarser relations was, without a doubt, found in the Baltics.

The stalwart among these nations challenging Beijing was Lithuania. For Vilnius, the past year marked the ultimate end of its engagement policy and a turn towards a values-based approach, more aligned with the current US stance on China. In May 2021, Vilnius officially left the controversial 17+1 platform for cooperation between Beijing and CEE after downgrading Lithuania’s delegation at the February summit of the initiative to the ministerial level.

After having opened a Taiwan representative office, Vilnius was confronted with a full-scale coercion campaign by Beijing. This was manifested in a downgrading of diplomatic relations effectively forcing Lithuania’s diplomats to leave China, an informal ban on imports, pressure on companies from third countries to stop cooperating with their Lithuanian suppliers and an international media campaign to discredit Vilnius.

Lithuania’s neighbor Poland chose a quite different path, despite also having close ties with the US and similar security concerns vis-à-vis Russia. Since Joe Biden took office, Warsaw’s relations with Washington began to deteriorate as their views on certain norms and values became visibly divergent. The introduction of a controversial law limiting foreign media ownership in Poland, including an important American-owned broadcaster TVN, further soured bilateral relations.

In this worsening international climate, the Polish government turned towards China in a surprising rapprochement after several years of limited engagement during Donald Trump’s presidency. In late May, Poland’s Minister of Foreign Affairs Zbigniew Rau visited China, where he met with his counterpart Wang Yi to discuss “issues of strategic importance to both countries.”

Throughout the year, several high-level interactions took place, with a meeting of the third Sino-Polish Intergovernmental Committee concluding in December. Despite this tightening of relations with Beijing, Warsaw also developed ties with Taipei (e.g. by becoming the biggest European vaccine donor to Taiwan), thus maintaining some level of ambivalence in this regard.

Other V4 countries also adjusted their China policies in 2021. Czech Republic’s ties with Taiwan grew stronger throughout the year. Although the PRC did not occupy a lot of space in the run-up to the legislative elections, their results suggest that the country might take an even more assertive stance on China, e.g. regarding human rights violations and Beijing’s approach toward Hong Kong, Tibet and Xinjiang.

As for Slovakia, similarly to Lithuania and Czechia, Bratislava expressed support for Taiwan multiple times while simultaneously distancing itself from Beijing. The nation not only donated vaccines to the island, but also hosted a large Taiwanese delegation as well as Taiwan’s Minister of Foreign Affairs Joseph Wu and organized the first session of the Taiwanese-Slovak Commission on Economic Cooperation.

Even Hungary, Beijing’s closest partner in the region, displayed signs of internal divisions regarding its China policy, as thousands of people rallied in Budapest against the planned construction of a local branch of Shanghai’s prestigious Fudan University – a project accused of lack of transparency and potential corruption. The issue is likely to resurface as Hungary will hold its next parliamentary elections in spring 2022.

Although Western Balkans have been generally more open to cooperation with China due to their developmental needs, only Serbia’s “steel friendship” remained a constant in Beijing’s relations with CEE states in 2021.

Montenegro came close to becoming the first European case of China’s infamous “debt-trap diplomacy” when Podgorica announced in April that it was unable to repay its $1 billion Chinese loan. Other Western Balkans states, such as Albania or North Macedonia, expressed very limited interest in cooperating with China in 2021, with the former not receiving any major Chinese investment since 2016 and the latter suffering from a mismatch between local demand and Beijing’s supply. Desire to maintain close relations with the US has also been a factor in the less than enthusiastic stance of some countries, e.g. in the case of Albania.

Finally, the border crisis between Belarus and Poland as well as the Baltic states was one of the defining features of the regional security situation in 2021. Although China has been relatively silent on the issue, it has hinted towards its “special” relationship with Minsk.

In mid-December, Chinese media were already highlighting Belarus’ willingness to increase exports to the PRC as an alternative to Lithuanian products and the country’s promises to uphold the one-China policy. Meanwhile, Beijing and Moscow have declared the intention to continue to cooperate on fighting “color revolutions” – a reference to the pro-democracy protests in Belarus, among others. Chinese media’s new-found focus on highlighting Sino-Russian friendship suggests that the topic is here to stay as long as both countries share some strategic interests, such as their competition with the US-led international order.

All these developments were unfolding against the backdrop of the prolonged pandemic: a factor that has already become the new normal despite its constantly evolving character. But what do China’s reactions to changes in some CEE states’ attitude towards Beijing tell us about the future of its relations with both the region and the EU more broadly?

2022: Masks off

Beijing’s fury over Lithuania’s decision to engage with Taiwan is a litmus test of its allegedly non-confrontational vision of international order based on declarative non-interference in other countries’ internal affairs and depoliticization of trade relations. A closer look at the rhetoric and actions of Chinese officials and media, however, suggest inconsistencies in Beijing’s logic regarding the current rise in Sino-skepticism in Europe, including CEE.

According to Chinese Foreign Ministry spokesperson Zhao Lijian, Lithuania’s decision to limit relations with the PRC for the sake of closer cooperation with Taiwan is a “dangerous provocation” and a trend that should “be swept into the garbage bin of history.” Chinese state-affiliated media accused Lithuania of subservience and being instrumental to Washington’s policy, but they also did not hesitate to call in the big guns by evoking Lithuania’s historical problems with anti-Semitism or running secret prisons for the US and allegedly torturing refugees on its border with Belarus.

These declarations showcase that crossing China’s ‘red lines’, even at the very symbolic level of language (i.e. Vilnius allowing the office to represent Taiwan instead of Taipei), is currently seen in Beijing as a cardinal sin which calls for an all-out response. Seen from Europe, China’s reaction seems both intimidating and overblown, yet for Beijing it is emblematic of its new-found drive for a more assertive pursuit of CCP’s own interests.

It also points toward a growing perception gap between Western democracies and China, only exacerbated by the pandemic-related isolationism. In Chinese state-affiliated media, smaller countries like Lithuania, which act against Beijing’s interest, are portrayed as passive and fearful executors of bigger actors’ goals, and punishing them should be like “swatting a fly.” According to Global Times, the fact that Lithuania dares to “show off its teeth” reflects “the loopholes in China-US ties and China-Europe ties that enable it to behave so badly.”

In other words, because of Lithuania’s closeness with Washington and its EU membership, Vilnius is seen as disproportionately bold. If that is indeed China’s reading of the current situation, its main aim will be to alienate Lithuania-like actors, undermine EU unity and work towards fraying ties between the US and the EU. In Beijing’s world order, there is no place for the agency of smaller states, as their behavior is seen as a reflection of respective major powers’ interests.

This kind of social Darwinist outlook, coupled with economic coercion, is in stark contrast with Beijing’s declarations of peaceful coexistence with other countries no matter big or small. It is also a test for both the EU and the US – if they both fail to substantially support Lithuania, it will have consequences not only in Europe, but also in Asia. For Russia and Belarus, it will be a sign to keep on exploiting hybrid warfare, e.g. through further weaponization of migration on NATO’s eastern flank. For China, it will be another sign of Washington’s lack of appetite to support its allies. For CEE, possible Sino-Russian long-term convergence of interests poses new challenges, such as their joint support for the regime in Minsk.

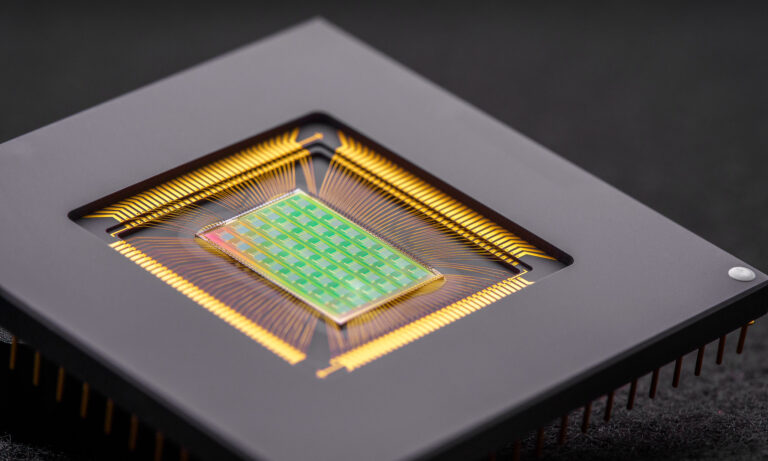

When it comes to pragmatic benefits of cooperation with Taiwan, 2022 might be the year when strengthening of relations bears fruit. CEE states have expressed their interest in establishing exchanges with Taiwanese high-tech companies, especially in the valuable semiconductor sector. However, over-relying on promises might lead to yet another disillusionment, just like in the case of high expectations towards cooperation with China in the ‘golden age’ of 17+1 a couple of years ago. Taiwan’s largest chipmaker TSMC is already in preliminary talks with Germany to build a factory there. Intra-European competition for investment seems bound to continue in 2022, while domestic frictions relating to China policy are most likely to grow in CEE states.

Days before the new year, Chinese Minister of Foreign Affairs Wang Yi declared Europe suffers from a “cognitive split” in its China policy, referring to the EU’s official standpoint on treating Beijing as both a partner and a rival. However, what the PRC perceives as inconsistency is ultimately a necessity for Europe.

Coincidentally, the EU is not alone in this schizophrenic behavior. China ignores a similar “cognitive split” in its own behavior, be it towards Lithuania or the EU as a whole. As shown also in the case of Australia, if acting against Beijing’s core interests, China’s role as a partner can easily turn to rivalry. As 2022 begins, it seems this cognitive split is set to only become even more pronounced.

Written by

Alicja Bachulska

a_bachulskaDr. Alicja Bachulska is a Research Fellow at CHOICE and Policy Fellow at the European Council on Foreign Relations where she focuses on Chinese foreign policy and China-EU relations.