This article was originally published by International Politics and Society. The article is also available in Russian.

Over the past ten years, China’s growing power, as well as its increasing geopolitical engagement has become a well-known fact. A distinct regional version of this idea can be seen in Central and Eastern Europe (CEE), where, despite its geographical distance, China’s presence has become increasingly visible in recent decades.

The Belt and Road Initiative has become a tangible expression of the form and extent of the projection of China’s power on a global scale, and Beijing’s gamble on the CEE region could pay off. Last year, China’s trade with the countries that are part of the 17+1 Initiative grew by eight per cent, which is nearly three times higher than the overall rate of growth of China’s foreign trade. For the first time, total trade volume exceeded the $100bn mark.

Against this backdrop, as expected, discussions have ensued about China’s attempts not only to penetrate and gain a foothold in the region, but also to sow confusion and dissent in the European Union itself. Western Europe, and especially the ‘Big Three’ made up of Germany, France and the UK (down to the ‘Big Two’ since Brexit) have eyed the CEE countries with suspicion as they have deepened and institutionalised their cooperation with China. It seems that EU membership did not prevent them from pursuing their own foreign policy priorities and utilising the partnership with this growing centre of power in their own interests. How China’s own long-term interests will be compatible with those of the EU is an even more acute question.

Sino-American Standoff

With the Sino-American rivalry likely to become the single most important factor defining international politics in the coming years, the stakes are getting higher (and this time not only for China). The CEE countries’ relationship with Beijing has acquired new geopolitical significance.

The conflict between the US and China is determined by both material factors and the perception focus — and in this respect is a typical manifestation of the security dilemma. In terms of GNP, based on purchasing power parity, China has already overtaken the US. Its defence budget is increasing year by year, and, although the exact figures are not accessible, estimates based on last year’s indicators range from $178bn to $261bn. The latter figure is the equivalent of almost 35 per cent of American military expenditure. No other country has come this close to the US in terms of military spending in the last 30 years, let alone overtaken it in terms of the size of the economy.

China’s dynamic economic development is not clear cut. The structural problems of the economy, and indeed its very character, the state of the environment, gaps in regional development — all of this has to be taken into account if we want to accurately assess the balance of power. That said, based on the former indicators, China still has a pretty high chance of overtaking the US in the medium term.

This struggle will no longer be characterised by rivalry between two adversaries. The race to secure allies is already on, and the US is at a significant advantage. America’s network of allies covers both the Euro-Atlantic community and key regions in Asia, including some that are of vital importance to China. The Biden administration has already defined the contours of the future ideological front: democracy in the fight against authoritarianism. This will enable the White House to increase its advantage in the scramble for allies even further, narrowing China’s options, and raising difficult questions to the CEE countries. China’s investment, its infrastructure projects and market — all this is very attractive, but not at the cost of weakening the integrity of democratic values and at the risk of undermining relations with the US.

American Soft Power

By all accounts, the group of CEE countries that are part of the 17+1 platform are facing these questions as we speak. Indeed some are already prepared to answer them. And Beijing is unlikely to be very happy about their response.

For many of the CEE countries, last year brought disappointment and frustration when it came to potential cooperation with China. Overall, China’s total investment volume in European member states fell to 2012–2013 levels — and the CEE countries were not exempt from this trend. Moreover, for China, these countries are not a priority, with Northern Europe and the ‘Big Two’ much higher on its agenda. China’s total investment volume within 17+1 amounted to $3.1bn, which is a meagre sum.

In 2012, Europe had high hopes and expectations of the 17+1 platform. Industrial development, extensive infrastructure projects, China’s gateway to Europe — all of this appeared to be on the cards. Now, after nine years of cooperation within 17+1, the initiative is mocked by many as being nothing more than forums, exhibitions and exchange programmes.

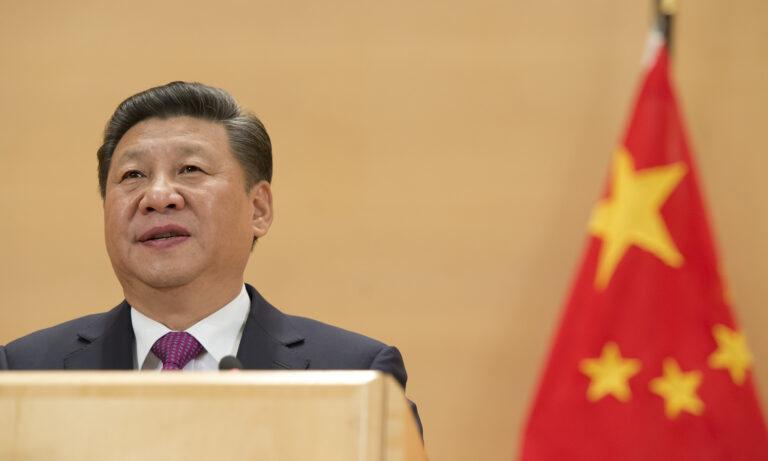

After being postponed as a result of the Covid-19 pandemic, the latest 17+1 summit eventually took place online in February of this year. During the event, the gravity of the problems was made abundantly clear. Despite China’s diplomatic efforts, Slovenia, Romania, Latvia, Lithuania, Bulgaria, and Estonia reduced the weight of their delegations, ultimately only sending representatives at ministry level. China, on the other hand, elevated its representation to the highest level — sending Xi Jinping to preside over the event.

The Chinese president was subjected to a great many very unpleasant questions from European participants, such as why the opening of the Chinese market to agricultural products from CEE was taking so long. The Europeans were quite pessimistic: Chinese investment volumes were small, infrastructure projects significantly more modest than originally announced, and cooperation remained unbalanced. The Chinese president responded with promises to expand logistic capabilities, to expedite the supply of Chinese vaccines to CEE and to increase imports of agricultural products from the region to $170 billion, but, in light of the new geopolitical conditions, this is unlikely to go far enough for the Europeans.

Intentionally or not, accelerating confrontation with China changes the map of opportunities and risks for the CEE countries. It brings about an undesirable side effect in the form of a dilemma of values. The rationale of bipolar confrontation will prompt CEE countries to opt for a less ambiguous and more predictable policy.

Restricting Influence

The activities of Chinese investors are increasingly being restricted in CEE countries. For instance, in May 2020, Romania cancelled a deal with China to build two new nuclear reactors in Cernavoda. Following Washington’s lead, Poland, the Czech Republic, Romania, and Estonia have all considered restrictions on Huawei’s operations in their respective countries. The region is also voicing stronger criticism of China’s policy on national minorities, Hong Kong and human rights in general.

Ukraine’s decision regarding the nationalisation of the Motor Sich Joint Stock Company can be considered in keeping with the overall regional trend. The difference here, however, is that the 17+1 countries can afford to adopt a harsher position, and a certain amount of chill in relations with Beijing would be more painless for them than for Ukraine. After all, Ukraine is not an EU member state and has no one to underwrite its risks. Instead, it shares a border with an aggressive Russia, raising the cost of any foreign policy mistakes.

China is in no hurry to make its partners wealthier. When it declares principles of bringing shared prosperity to the world, Beijing is primarily pursuing its own goals: to set up supply chains and to lobby for its own commercial interests. It is certainly not particularly willing to open its markets, and in general sees the Belt and Road Initiative as more of a springboard for its own entry into the world of modern developed economies, than as an instrument for shared prosperity with other countries participating in this mega project.

The European market is certainly of great interest to China, and the countries of Central Asia and Eastern Europe are important as routes and corridors. But in the changing geopolitical realities, the price of political issues is dramatically increasing — including the very issues which China is doing its best not to raise or even is trying to ignore.

Today it is clear that there are political issues and that these are playing an increasingly important role. China will be required to invest more effort and pay a higher price for its partnership with Central and Eastern Europe. Perhaps China could broaden the geographical scope or split the winnings, so as not to reinforce Europe’s impression that it is only prepared to invest money in those projects where it alone receives the lion’s share of the profits, as was the case with its acquisition of the port of Piraeus in Greece. Another possibility would be to offer the countries in the region something that goes beyond trade and infrastructural advantages.

Written by

Nickolay Kapitonenko

Nickolay Kapitonenko is an associate professor at the Institute of International Relations at Taras Shevchenko National University of Kyiv and director of the Centre for International Relations Studies.