In recent years, the relationship between Serbia and China has experienced a remarkable upswing, marked by the intensification of economic and political cooperation between the two nations. Often characterized as a “steel friendship,” this burgeoning alliance has elevated Beijing to a position of prominence as one of Belgrade’s most significant partners.

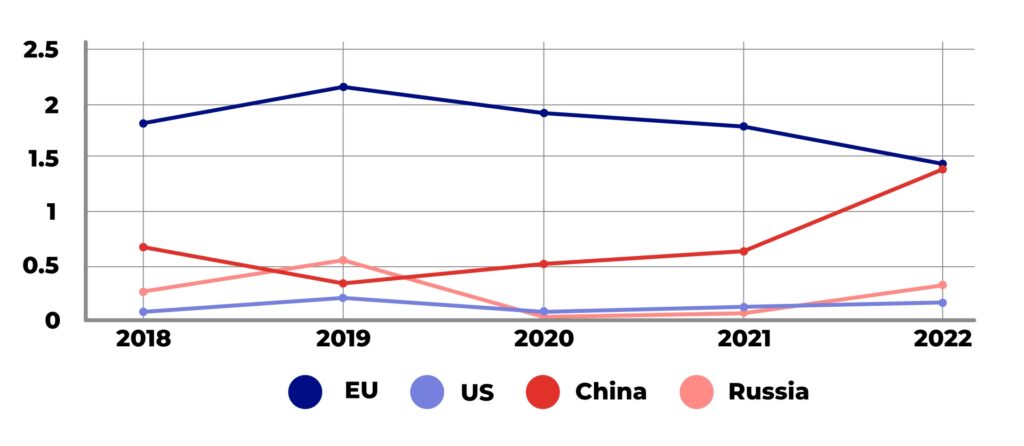

Serbia stands out as a focal point of Chinese footprint not only in the Western Balkans but also across Central and Eastern Europe, resulting in China emerging as the largest individual investor in Serbia. By 2022, Chinese investment in the country had reached the level of the combined investment of all 27 European Union member states, solidifying the multifaceted nature of their bilateral engagement.

From Humble Beginnings to Rapid Expansion

The inception of contemporary relations between Serbia and China can be attributed to the signing of the Framework agreement on economic and technological infrastructure cooperation in 2009. The initial phase of cooperation prominently feature foreign direct investment (FDI) and it revolved primarily around loan agreements extended by Chinese banks to facilitate the infrastructural development of Serbia. Thus, the early stages of economic cooperation between Serbia and China saw only limited investment from the latter, as indicated by data provided by the National Bank of Serbia. From 2010 to 2015, Chinese investment in Serbia amounted to a mere €189 million, paling in comparison to the robust inflow of FDI from EU countries, which exceeded €7.2 billion during the same period.

While loan agreements provided initial support, the Serbian government actively sought to attract more significant investments from Chinese entities. As the Belgrade-Beijing relationship matured, the focus gradually moved towards fostering a more significant inflow of FDI. This strategic shift was driven by the recognition of the need to ensure job creation and preservation, and boost reindustrialization – the primary modality for economic development pushed by the Serbian government.

However, a significant turning point occurred in 2016 when a momentous investment announcement heralded the beginning of a new era in Serbia-China relations. The landmark deal that catalyzed the further rise of Chinese FDI in Serbia was the acquisition of the Smederevo Steel Mill. The mill was managed by the Serbian government after U.S. Steel withdrew from the ownership structure in 2012, only to be sold to the Chinese HeSteel Group in 2016. The transaction stood at €42 million, with an accompanying promise of additional investments of up to €300 million. The large acquisition not only marked a significant financial commitment from China but also carried symbolic value due to its announcement coinciding with the visit of Chinese leader Xi Jinping to Serbia. The deal was emblematic of the burgeoning “steel friendship” between the two countries, a phrase frequently used to characterize their bilateral relations.

Serbia witnessed the next significant milestone in its efforts to lure Chinese investment in 2018. The construction of a vehicle tire factory in Zrenjanin by the Chinese Linglong company was hailed as the largest greenfield investment at the time. Concurrently, the acquisition of a 63 percent share of the Mining and Smelting Combine Bor by the Zijin Mining group was announced. The investments, estimated at approximately €1 billion each, underscored China’s growing presence in Serbia’s economy. Moreover, Zijin Mining also strategically moved to secure mining rights in the Čukaru Peki region through the acquisition of Nevsun mining company for €1.2 billion and subsequent agreements with Freeport McMoran. These deals have positioned Zijin Mining as a key player in Eastern Serbia’s mining industry, effectively establishing a near-monopoly over this region’s mining sector.

Even in the face of the global COVID-19 pandemic, Chinese investment in Serbia has exhibited resilience. Data provided by the National Bank of Serbia reveals a consistent upward trend in Chinese FDI in the country, with notable growth observed since 2020. In a significant milestone for bilateral relations, Chinese FDI surpassed that of any individual member countries of the EU, including the big players like Germany or France in 2021, as well as other major non-EU partners such as Russia, the United States, the United Kingdom, Switzerland, and Norway. The latest data from 2022 shows that the investment from China, totaling €1.4 billion, almost reached the level of the combined FDI from all 27 EU members at €1.46 billion.

Graph: Chinese FDI Stock in Serbia (€ billion), data by the National Bank of Serbia

Mining and Automotive Industries as a Leading Target

The Chinese Ministry of Commerce, in a comprehensive 2022 document titled “Country Guidelines for Foreign Investment and Cooperation,” has identified mining, metal manufacturing, and the automotive industry as the primary sectors of Chinese investment in Serbia. Notably, the nature of investments in these sectors varies, with the metal manufacturing and mining industry witnessing a combination of brownfield acquisitions, such as the purchase of the Smederevo Steel Mill and Bor mines, as well as greenfield investments, such as the Čukaru Peki project.

On the other hand, the automotive sector has primarily attracted greenfield investments. While the prominent investment in this sector is the Linglong vehicle tire factory, there are several other investments that have not garnered as much public attention due to their smaller scale and less visibility.

The automotive industry in Serbia has witnessed a notable expansion in Chinese investment, with several noteworthy projects contributing to the sector’s growth. Among these investments, Minth Automotive Europe stands out as a prominent player, establishing its presence in Western Serbia. The company has implemented its first phase of investment in the city of Loznica, with an estimated worth of €100 million, and subsequently expanded its operations to the neighboring city of Šabac.

Additionally, Central Serbia, renowned for its automotive heritage with companies like Zastava established during the era of socialist Yugoslavia (later acquired by Fiat), has also attracted significant Chinese capital. Mei Ta Europe, with an investment reportedly valued at €150 million, established its presence in the Obrenovac Municipality, while Yanfeng automotive interiors company initiated a greenfield investment in Kragujevac, with an initial injection of €40 million and an additional €18 million announced. Despite its recognition as a Chinese investment, it is noteworthy that Mei Ta Europe’s parent company can be traced back to Taiwan which Serbia does not officially recognize, often labeled as “Chinese province Taiwan” in government statistics. Another investment of interest is Xingyu Automotive Systems, announced in 2020 with an estimated value between €50 and €60 million; however, progress beyond trial production has been limited, prompting substantial assistance from the Serbian government to facilitate full-scale production.

The surge in Chinese companies’ participation in Serbia’s automotive sector can be attributed to multiple factors. One primary catalyst is the Serbian government’s provision of significant subsidies and incentives to attract foreign investors. Beyond Chinese enterprises, Serbia’s automotive industry has also piqued the interest of companies from Germany, Italy, Japan, and South Korea, among others. Chinese firms, in particular, find the sector appealing due to favorable conditions such as low production costs, access to a skilled workforce, geographical proximity to the European market, and the presence of prominent players within the automotive industry. These factors collectively contribute to Chinese companies’ ramped-up engagement in Serbia’s automotive sector.

Table: Largest Chinese investments in the automotive industry

Consequences of the Rising Chinese Investment

The ascent of Chinese investment in Serbia has been closely intertwined with the overall growth of the Sino-Serbian partnership. It is noteworthy that the government’s efforts to attract foreign capital to boost domestic economic development extend beyond the allure of Chinese investment alone. However, in the past five years, Chinese investment has exhibited the most significant proportional growth. From the perspective of the Serbian government, the preservation and modernization of aging industrial complexes, which were previously mismanaged, burdened with debt, and underdeveloped, holds great importance.

This was particularly evident in the cases of the Smederevo Steel Mill and Bor mines, where protecting employment played a crucial role. In both instances, the initial contracts for both steel mill and mining combine stipulated the retention of a minimum of 5,000 jobs, effectively prohibiting layoffs. The revitalization of these complexes has in turn bolstered China’s image as a friendly nation and that of its companies as beneficial partners for Serbia.

However, the influx of Chinese investment has not been devoid of challenges. The mounting apprehensions stem from several factors. In the case of Smederevo, the increased production within the complex, which had not been fully modernized in compliance with contemporary standards, has resulted in heightened concerns over environmental impacts. Similarly, the Bor mines have witnessed aggressive land expropriation, necessitating the relocation of an entire village to facilitate further exploitation.

Furthermore, instances of alleged disregard for regulations and procedures connected to Chinese projects have emerged. For instance, the Zrenjanin Linglong investment project commenced construction without proper permits, thereby impeding public participation in the debate around environmental impact assessments. Moreover, the reported mistreatment of workers from Vietnam contracted for the construction of the complex in Zrenjanin has called attention to the issue of labor treatment and working conditions, something that was also concerning in the case of Chinese workers in Bor and Smederevo.

Ultimately, the long-term implications of these investments remain uncertain. While the immediate advantages for the development of the national economy are impossible to negate, in the absence of enhanced regulation by the Belgrade government to ensure compliance with domestic laws, regulations, and standards, the overall costs of the investments in terms of environmental impact, non-compliance with established protocols, and misuse of resources may ultimately put a shadow of doubt over their positive contribution to Serbia.

Written by

Stefan Vladisavljev

vladisavljev_sStefan Vladisavljev is CHOICE Visiting Fellow. He is also the Program Coordinator of the Serbia-based non-governmental organization Foundation BFPE for a Responsible Society. He analyzes Chinese presence in Central and Eastern Europe with a special focus on Serbia and the Western Balkans.