The article is published as part of a joint issue “Green Synergies: Sustainability, Security, and Taiwan-Europe Collaboration” between CHOICE and the University of Nottingham’s Taiwan Insight.

As the European Union’s green transition gains momentum, ensuring the safe and sustainable supply of critical raw materials (CRMs) has become a strategic priority. Renewable energy and decarbonization technologies – such as electric vehicles, wind turbines, solar panels, and batteries – depend on critical minerals including lithium, cobalt, nickel, and different rare earth elements (REEs). The EU’s agenda, as outlined in the European Green Deal and the accompanying industrial policy, cannot be achieved without robust, dependable, and diversified mineral value chains.

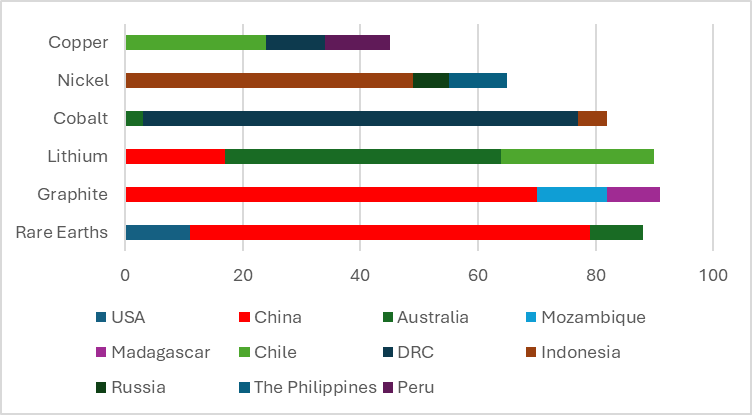

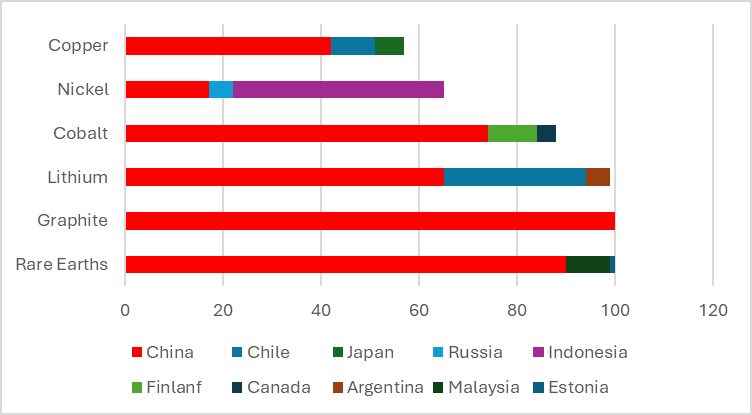

As shown in Figures 1 and 2, China currently controls the global market for critical minerals used in clean energy, both in terms of extraction and processing. This dominance has enabled the scaling of low-carbon technologies worldwide, making them cheaper and faster to develop. However, the concentration of mineral extraction and processing in a single country has generated concerns about supply risks, particularly in the context of increasing geopolitical tensions and export restrictions.

The EU has therefore adopted a “de-risking” approach: rather than severing economic ties, the aim is to reduce vulnerabilities by diversifying supply chains and building strategic partnerships. Although Taiwan is not a producer of raw materials, it emerges as a promising partner due to its relative strengths in high-tech manufacturing, advanced material processing, and regulatory alignment with the EU. This article explores opportunities for EU-Taiwan cooperation on critical minerals and how such cooperation can enhance the resilience and sustainability of both actors’ green industrial agendas.

Figure 1: Share (%) of top three countries in the extraction of critical minerals, 2022. Source: IEA.

Figure 2: Share (%) of top three countries in critical minerals processing, 2022. Source: IEA.

The EU’s Critical Minerals Agenda

The EU has taken significant steps to secure access to CRMs. The 2023 Critical Raw Materials Act (CRMA) sets ambitious targets: by 2030, the Union aims to mine 10 percent, process 40 percent, and recycle 15 percent of its annual consumption of critical raw materials domestically. The Act also emphasizes forming strategic partnerships with like-minded countries to secure sustainable imports, with a particular focus on improving traceability, ESG standards, and circular economy practices.

In addition to this legislation, the EU has launched initiatives such as the European Raw Materials Alliance and the Global Gateway strategy, which encourage responsible mining, processing, and infrastructure development abroad. The emphasis is not only on accessing raw materials but also on enhancing Europe’s capacity in refining, component manufacturing, and recycling – areas where a partnership with Taiwan may be particularly fruitful.

This approach reflects the EU’s broader push for strategic autonomy in green industries, which involves reducing dependencies not only in energy and digital infrastructures, but also in the material foundations of clean technologies. As the Union’s search for global partners increasingly prioritizes those with shared regulatory frameworks, technological innovation, and high-value supply chain capabilities, Taiwan stands out as a viable partner.

Taiwan’s Role in Global Minerals Value Chains

Taiwan lacks significant domestic reserves of critical minerals. Following its 2022 pledge to reach net-zero carbon emissions by 2050, it faces similar challenges as the EU, including surging demand for permanent magnet motors containing rare earths. REEs are particularly crucial for Taiwan, given their vital role in the island’s leading manufacturing sectors. They are key components in semiconductor production, which accounts for nearly 40 percent of Taiwan’s total exports. Despite this, Taiwan imports around 3,000 tons of rare earths every year, and has limited refining and processing capacities, with only one or two companies active in the upstream segment of Taiwan’s rare earths supply chain.

Nevertheless, Taiwan occupies a pivotal position in downstream segments of global mineral supply chains, particularly in high-tech manufacturing. Taiwan boasts an industrial base that includes companies engaged in the production of magnets, semiconductors, battery components, and other technologies that rely on stable and sustainable supply of critical inputs. Taiwan also plays a key role in the global smart machine supply chain, producing components and assembling products that depend heavily on rare earth elements. Other sectors also rely on REEs, including the growing medical technology sector, known for innovative treatments and virus detection tools. Taiwan’s high-tech industries are thus dependent on a stable REE supply chain across sectors.

Taiwan is also investing heavily in research and development (R&D) of circular economy for critical materials, including battery recycling and rare earths recovery. Companies such as Aleees (Advanced Lithium Electrochemistry) and E-One Moli (Molicel) are contributing to battery technology innovation. Non-profit and civil society organizations such as the Circular Taiwan Network contribute to developing mineral circularity strategies, while research institutions such as the Institute for National Defense and Security Research explore environmentally friendly extraction and substitution techniques, often through international collaborations. Taiwan has also sought to join global initiatives like the Semiconductor Supply Chain Initiative (SSCI), which, through TSMC’s involvement, contributes to securing the island’s critical mineral supply chains.

Taiwan’s high standards in industrial safety and environmental protection show regulatory convergence with the EU in areas such as sustainability reporting, emissions reduction, and traceability. In the context of critical minerals, the 2023 Climate Change Response Act promotes renewable energy development and energy security, and the accompanying National Climate Change Action Guidelines stress the need to manage supply chain pressures associated with renewable energy through international cooperation. These efforts align closely with the EU goals, such as those outlined in the updated Battery Regulation, which aims to increase the circularity of components with CRMs and secure supply chains in accordance with the CRMA, all while reducing environmental impacts and increasing self-sufficiency through innovation rather than extraction alone.

Potential Pathways for Collaboration

The complementarity between the EU’s strategic objectives and Taiwan’s industrial strengths creates a compelling case for deeper cooperation. While the EU has focused on securing diversified and green sources of critical materials, Taiwan excels in transforming these materials into high-value components. This downstream expertise – especially in the fields of electronics, mobility, and energy storage – is essential for achieving the EU’s green technology ambitions. Both sides also share an interest in enhancing supply chain transparency and traceability, especially considering the increasing scrutiny from investors, regulators, and civil society.

Several bilateral mechanisms already exist to facilitate collaboration, including annual trade consultations, an industrial policy dialogue, a dialogue on digital economy, and sector-specific working groups. These platforms offer opportunities to explore industrial partnerships or supply chain agreements in key sectors such as battery or electric vehicle manufacturing. The European Chamber of Commerce in Taiwan can help foster these partnerships by creating shared incentives for innovation and resilience. Similarly, as both regions move toward stricter environmental and due diligence standards, coordination on reporting frameworks, third-party certification, and traceability tools could reduce compliance costs and improve market access. The European Business and Regulatory Cooperation Program (EBRC) in Taiwan, created with the purpose of improving regulatory cooperation between the EU and Taiwan, could serve as a foundation for such joint efforts, especially when it comes to setting regulatory standards.

R&D presents another promising area for cooperation. EU and Taiwanese institutions could collaborate on substitution research (e.g., of rare earths alternatives for permanent magnets), low-impact refining technologies, and advanced recycling methods. These projects would not only reduce raw material dependencies but also support broader environmental sustainability goals. The EU’s Horizon Europe program and Taiwan’s Ministry of Economic Affairs could co-fund research into mineral processing, recycling, and sustainability innovations, involving universities and research centers, which could further broaden their impact.

As the EU accelerates its green transition, securing stable and sustainable access to critical minerals will remain a central challenge. While Taiwan is not a source of raw materials, its capabilities in processing, technology, and supply chain governance make it a partner with great potential. The EU’s emphasis on de-risking and diversification aligns well with a pragmatic, innovation-driven, and mutually beneficial approach to cooperation. By focusing on innovation, standards and industrial complementarity, EU-Taiwan collaboration can contribute meaningfully to shared climate and industrial goals, strengthening both actors’ positions in the evolving global green economy.

Written by

Blanca Marabini San Martín

BlancaMSMBlanca Marabini San Martín is a PhD student at the Centre for East Asian Studies of the Madrid Autonomous University (CEAO – UAM), in Spain, as well as part of the China Horizons Research Consortium. She has collaborated with the International Institute for Asian Studies (IIAS, Leiden), the Spanish Institute for Strategic Studies (Ministry of Defense of Spain), and the Spanish Chinese Policy Observatory. Her research interests center around the climate, environmental, and green tech dimensions of China’s foreign policy, particularly within the framework of EU-China relations.