Why Czechia’s Dream of a TSMC Semiconductor Factory Never Materialized

Semiconductors have become an omnipresent buzzword of the Czech-Taiwanese friendship, but cooperation remains limited by what Czechia can offer.

The semiconductor factory craze in Czechia we witnessed in the past three years was brought on by a concurrence of two separate chains of events, sparking hope for a substantial investment from Taiwan in this industry.

In spring 2020, TSMC, the Taiwanese semiconductor production giant, announced colossal investment plans. First, they initiated the construction of a large-scale factory in Phoenix, Arizona. A year later, the company announced a plan to create a joint subsidiary in Japan. Stirring up publicity and excitement, it was rumored that another immense investment would take place in Europe.

At the same time as TSMC announced those giant multi-billion global investments, a part of the Czech political representation started shifting the direction of Czech diplomacy, steering towards Taiwan.

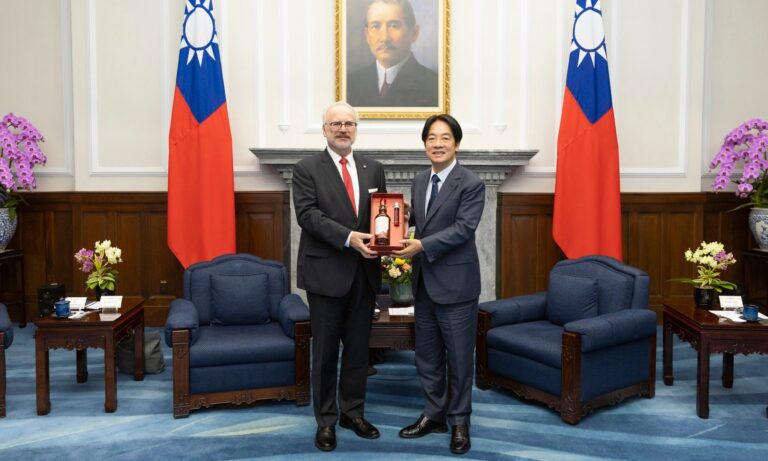

The era of intense strengthening of the Czech-Taiwanese bonds officially commenced with the widely debated 2020 visit of the Czech Senate President Miloš Vystrčil to Taiwan that included a notable speech in the Taiwan Parliament (the Legislative Yuan). After the 2021 election to the Czech parliament that ushered in a new government led by a coalition of center-right parties, Vystrčil’s visit was followed by two other large visits in the subsequent years – first, a delegation led by Senator Jiří Drahoš in 2022 and later, a grand delegation headed by the Czech Chamber of Deputies Speaker Markéta Pekarová Adamová in spring 2023.

Although the political aspect of the visits attracted a substantial amount of attention, all of them included a significant business element. Still, the fact that the delegations also included a number of top officials attracted a substantial amount of attention and led to China’s protests and soured ties between the two countries.

Taiwan has been known for its high-tech industries, especially its dominance in the semiconductor manufacturing business. In Czechia, there were hopes for future semiconductor cooperation that could be brought on by the commencing political camaraderie, potentially even scoring a semiconductor deal similar to Arizona or Japan.

Taiwan’s Semiconductors: What’s So Special?

Taiwan’s most prominent semiconductor manufacturers, including TSMC, are based on a unique business model – the so-called “foundries” or “fabs” (short for “fabrication”) are exclusively focused on the production of semiconductors which are designed by other companies, typically located in the US or South Korea. Due to the complexity of chips, the manufacturing process is highly specialized, requiring an extremely niche workers’ skill set. Taiwan’s TSMC, the most successful foundry in the world (measured by global market share), currently holds an astonishing 55 percent of the global market.

Semiconductors turned out to be a supreme choice for Taiwan. In the 1970s, Taiwan focused on purposefully moving away from low-end manufacturing, choosing specifically the industry of semiconductors. For this purpose, the Taiwanese government created ITRI (Industrial Technology Research Institute), an institute that set the foundation for Taiwan’s bright semiconductor future. ITRI focused on training integrated circuits specialists and transferring know-how from the US which was the epicenter of semiconductor research at the time. ITRI set up Taiwan’s first wafer fabrication plant in 1977 and then kept on climbing the semiconductor ladder. TSMC, based on the unique “foundry” business model, was launched in 1987.

Taiwan has become a prosperous hub of global semiconductor production and innovation, and Taiwanese foundries currently produce over 60 percent of the world’s semiconductors and over 90 percent of the most advanced chips. Used in most electronics, semiconductors continue to be a strategic investment with no foreseen expiration date in the near future.

Germany Takes the Crown

The Czech visits to Taiwan often emphasized the potential of Taiwan’s semiconductor industry and tried to foster a semiconductor partnership. The efforts, however, primarily materialized through different memorandums of understanding on cooperation in the industry that were signed during both the 2022 business delegation, led by Jiří Drahoš, and the 2023 delegation, led by Markéta Pekarová Adamová. Yet the trouble with memorandums is that they do not create any formal obligation for any of the sides. And while one is focused on signing the memorandum and seeking publicity, another country might be signing a substantial contract.

In the summer of 2023, the TSMC giant officially announced its commitment to building its first plant in Europe – and, to the disbelief of a part of Czechia, the plant would be located in Dresden, Germany.

However, taking a closer look, this decision should not come as a surprise. No matter how much unprecedented political support the Czechs show, business decisions tend to remain rational – Dresden provides benefits for TSMC that can hardly be found anywhere else in Central Europe.

Importantly, the area provides an already established semiconductor industry base. The regional government has made it a priority to create a suitable environment for large-scale high-tech manufacturing projects. The Saxony region in Germany has been deliberately fostering semiconductor businesses for a long time and started attracting major companies decades ago. Companies such as Bosch and GlobalFoundries had invested in their own wafer fabs in the area long before TSMC initiated its global expansion.

Saxony thus provided an area with developed infrastructure, ample land and well-established companies open to partnerships. Indeed, the Dresden project is a cooperation of TSMC, Bosch, Infineon and NXP that reside in the area. Additionally, and probably most importantly, the government provided an irresistible financial incentive in the form of a €5 billion subsidy to support the project, representing a whopping half of the total costs.

Overall, Czechia can not provide a tech hub as Dresden can, lacks large available land areas for construction and failed to compete in the realm of significant government incentives. After the Dresden announcement, the leader of the grand 2023 delegation Markéta Pekarová Adamová, acknowledged the original plans to be overly optimistic: “After a realistic consideration of all options, we concluded that semiconductor production cannot be executed in the Czech Republic, for now,” suggesting that a TSMC semiconductor factory was never a viable option.

Not All is Lost

In general, TSMC’s biggest challenge when establishing new plants outside of its home region is the lack of skilled workers. This can be seen in the newly constructed Arizona foundry – as reported by BBC, the TSMC plant has delayed the start of production explicitly due to a lack of talent. Although the US has a history of semiconductor production and chip design, the plant was faced with a shortage of qualified workers. Because of this, it was even necessary to fly in Taiwanese technicians to train workers for the factory, thus prolonging the process by several months. Combined with low rates of unemployment (on average under 3.8 percent), talent attraction and workers’ motivation for retraining have been a great challenge. The chances are that the situation in Europe will be even more challenging, due to a lack of experience in semiconductor production and/or design.

Even though Czechia did not score a Taiwanese semiconductor plant, the Czech future in semiconductors does not rely only on cooperation with the island nation. In fact, Czechia already hosts several highly successful companies in the semiconductor field, notably, the American-owned Onsemi group that runs a semiconductor production plant and two design centers, employing over 2000 people (a similar number of employees as the announced Dresden plant). Moreover, Onsemi is mulling a large $2 billion investment in Czechia (almost the same amount as the investment of TSMC). However, the chips produced by Onsemi are not in competition with the most cutting-edge chips manufactured by TSMC, and represent a different market niche.

Besides Onsemi, Czechia also hosts STMicroelectronics and Renesas Electronics which produce semiconductors for Apple. There are also a number of companies producing equipment and providing related services – such as the fully Czech-owned company, SVCS, which delivers high-tech furnaces used in the most advanced semiconductor production plants (such as Taiwanese ITRI). Similarly, the South Moravian Thermo Fisher Scientific and Tescan companies both focus on production of equipment for semiconductor companies. Obviously, the Czech market does have the potential to attract successful players in the semiconductor field.

However, it is apparent that the market was never prepared for a TSMC-sized investment. For now, Czechia can enjoy the humble fruits of political cooperation with Taiwan, represented by government-supported programs such as the Taiwan Semiconductor Scholarship Program or the newly established Supply Chain Resilience Program at Charles University. A glimpse of hope for developing a high-end advanced semiconductor industry could be the promised chip design center to be set up in Brno in cooperation with Taiwan, assuming that Czechia manages to find enough talents to work in it.

Written by

Michaela Zbrojová

MichaelaArmourMichaela is an intern working in the team of China projects at the Association for International Affairs (AMO) in Prague.