For over a decade, Belarus has seen China as a strategic opportunity for its foreign policy. Unsurprisingly, China is largely perceived as an economic opportunity for the Eastern European country.

Sino-Belarusian economic cooperation mainly revolves around three pillars: bilateral trade, Chinese investment projects, and the China-Belarus industrial park ‘Great Stone’. While each of these three pillars has developed noticeably over the last decade, they are becoming increasingly troubled from Minsk’s perspective, throwing a shade of doubt on the relationship.

Belarus’s Exports to China: Potash Prevails, Trade Deficit Widens

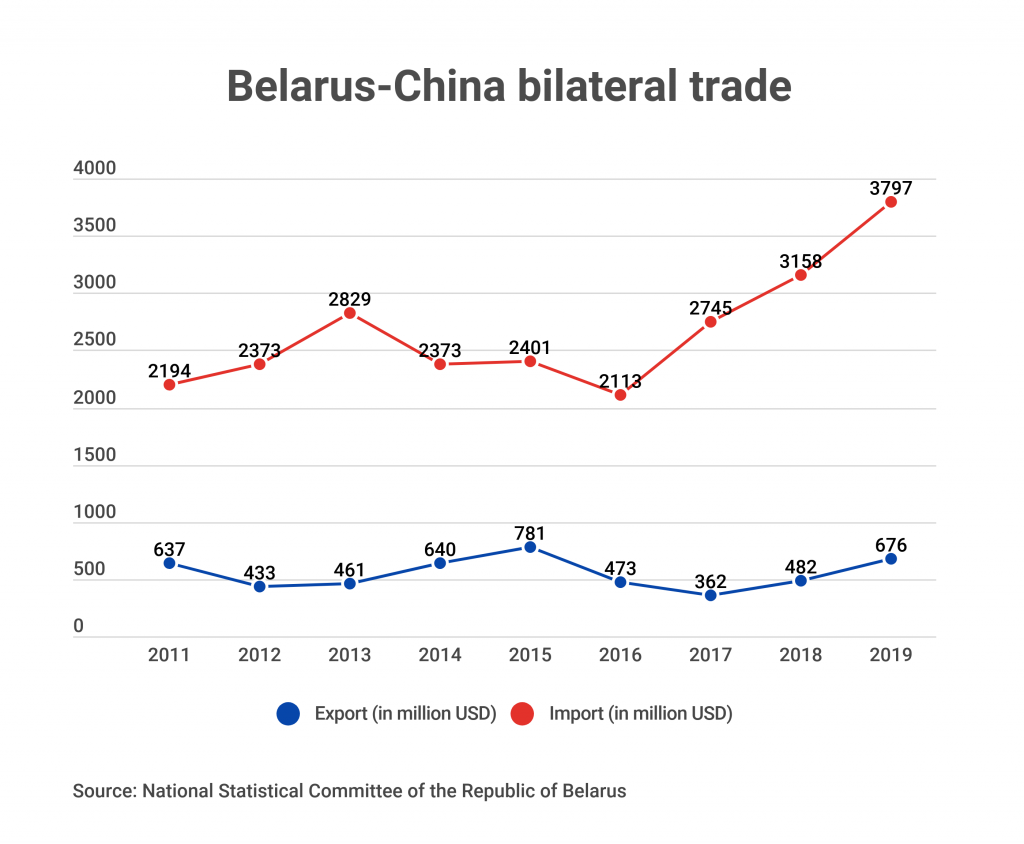

Despite Belarus’s long-standing goal of more balanced trade with China, the trade deficit has only increased in the last few years and exceeded $3 billion in 2019 (See Graph 1). Belarus’s export diversity is limited, whereas imports from China include a wide array of industrial goods and technologies.

Raw materials, such as potash and wood, account for around two thirds of Belarus’s exports to China (over $430 million in 2019). Petrochemical goods such as plastic are another important export category. On the other hand, the share of machinery, industrial products and electronics in Belarusian exports to China is negligible.

The only hopeful trend in Belarus’s trade with China seems to be increased agricultural exports. Last year the volume of export of Belarus’s meat, dairy products, and other agricultural goods exceeded $120 million. Until 2018, agricultural exports from Belarus to China were virtually non-existent.

Potash is still the main commodity in bilateral trade. In April 2020 Belarus inked a potash deal with a consortium of Chinese companies at a price of$220 per ton, a $70 decline from the price agreed in previous contracts. It was heavily criticized by Russia-based Uralkali, one of the largest competing potash producers. Uralkali had previously been in alliance with Belarus’s state-owned Belaruskali company until a scandalous break-up in 2013.

As one of the world’s largest potash consumers, China has long been eyeing investments in Belarus’s potash sector. In 2015, the China Development Bank, Belarusbank, and Slavkali, a company owned by Russian billionaire Mikhail Gutseriev, signed a memorandum on the construction of a new potash factory in Belarus, making use of a $1.4 billion Chinese loan.

Problematic Investment Projects: Billions in Outstanding Debts

Belarus receives little Chinese direct investment with Chinese FDI into Belarus’s economy totaling $368 million between 2010 and 2018. However, Beijing has been generously providing “tied loans” to Minsk. Around $8 billion has so far been allocated to Belarus-based projects out of $15 billion pledged by China in 2009.

China CAMC Engineering, CITIC Group, Huawei and ZTE are among the most active Chinese companies in the Belarusian market. Belarus-China agreements benefiting from Chinese tied loans usually bind Belarusian companies to purchase 50-75 percent of project equipment from China.

Overall, Belarus-China investment cooperation is characterized by:

- Insignificant Chinese direct investment

- “Tied loans” provided on non-transparent and non-publicly accessible terms

- Outdated technologies used by Chinese contractors

- High nominal value of construction works versus their low actual cost

- Ecologically hazardous technologies often applied

- Poor business plan management on the Belarusian side, medium-term prospects of targeted sectors insufficiently taken into account

- Positive political rhetoric and rosy plans dominate over solid economic arguments

Many of the most problematic large investment projects in Belarus were financed with Chinese loans, a December 2019 governmental meeting acknowledged. These problematic investments include the Svietlahorsk pulp and paper plant and the Dobrush paper plant. Belarusian President Alyaksandr Lukashenka’s visits to these two factories were among the most important themes on Belarus’s state-owned TV channels in February 2020.

The Svietlahorsk case stands out for the volume of losses for the Belarusian side, as the project’s cost totaled $850 million, of which $654 million were loaned by Chinese banks. The factory was originally planned to launch in 2015 but deadlines have been repeatedly postponed. In August 2019 the Belarusian side announced it will finish construction of the factory independently. Pulp production in Svietlahorsk was officially launched only in February 2020 during Lukashenko’s visit.

In the case of the Dobrush paper plant, a Chinese loan of $350 million was awarded and Xuan Yuan Corporation was tasked with the plant’s modernization. The project started in 2012 with completion planned for 2015. The Belarusian side ended the contract with Xuan Yuan in 2018, claiming that the company was not capable of finishing the project due to its lack of relevant experience. The Chinese company, in turn, criticized Belarusian regulations and excessive bureaucracy.

Today Belarus reportedly needs to invest an extra $83 million to complete the Dobrush factory’s modernization, this time with assistance from an Austrian company. While visiting Dobrush, Lukashenko promised to have a serious discussion with Chinese leader Xi Jinping about the sloppy work of Chinese companies in Belarus.

Belarusian pulp and paper plants are not the first largescale failures among Belarus-China investment projects. A cautionary tale of three Belarusian cement factories took place over a decade ago. Chinese CITIC Construction was in charge of their modernization, planned for the period between 2007-2010 and financed with $500 million by the Export-Import Bank of China. The modernization of these three cement factories took longer and was more expensive than initially projected. The project ended in 2013 with a total cost of $1.2 billion and did not bring the expected benefits. Yet, outstanding debts of the cement industry exceed $1 billion, Lukashenko said in May 2019.

Great Stone Industrial Park: Big Hopes, Little Fruit So Far

Minsk and Beijing place big hopes on the China-Belarus Industrial Park ‘Great Stone’ which officially opened in 2012. Great Stone was intended to become a self-contained manufacturing, urban and high-technology center with infrastructure allowing for a city of 50,000 inhabitants. The China Exim Bank and the China Development Bank provided $3 billion in loans to develop the Park. Xi Jinping once described it as a “model project” under the Belt and Road Initiative, while Lukashenko said the Park’s exports will reach $50 billion in future.

The Great Stone Industrial Park is modelled on the China-Singapore Suzhou Industrial Park, established back in 1994. The Suzhou Industrial Park was heavily loss-making for six years and was nearly closed by 2000. Luckily, its profound reorganization ultimately resulted in a success story. The China-Singapore industrial park’s history proves how challenging the management of such giant projects is and the importance of consistent efforts by both sides to make the project more efficient. Eight years on, Great Stone’s prospects do not look as optimistic as that of its China-Singapore counterpart.

A few years ago Belarusian authorities announced plans to have 100 resident companies at Great Stone by 2019. Yet, as of mid-2020, only 60 companies reside in the China-Belarus Industrial Park and benefit from its property, land, and income tax exemptions and other advantages. Planned benchmarks on the volumes of production and investment have not been reached either. Until China gives larger importance to the Belarusian node of the BRI – which is not anticipated in the near future due to the implications of the coronavirus pandemic, among other things – no breakthrough is likely to come in Great Stone’s development. Thus, while originally designed as a showcase of bilateral cooperation, the Great Stone Industrial Park instead turned into a parable of unmet expectations.

An overview of economic cooperation with China shows that Belarus’s ambitious plans to benefit from Chinese investment and participation in the China-led BRI continue to be confronted with harsh realities. Minsk needs a more prudent approach to overcome an increasingly disadvantageous economic relationship with Beijing. This change in approach will likely depend on the development of bilateral cooperation in other areas and Belarus’s relations with Russia and the West. However, the need to maintain a strategic partnership with Beijing in political and military spheres may outweigh Minsk’s concerns over problematic economic cooperation.

Written by

Andrei Yeliseyeu

Andrei Yeliseyeu is the Research Director of the Eurasian States in Transition Research Center (EAST Center), Belarus/Poland.