The beginnings of Bulgarian-Chinese financial cooperation did not appear particularly promising back in 2017 when the state-owned Bulgarian Development Bank (BDB) signed a $50,000 agreement for a credit line with the Export-Import Bank of China. Significantly larger Chinese offerings were being made in other parts of South-East Europe and the government in Sofia was somewhat impatient to join the queue. That time seemed to had arrived in July 2018, when BDB entered a €1,5 billion contract with the China Development Bank. Moreover, the agreement envisaged a very wide range of financing possibilities and was not linked to any specific project. It seemed that Beijing’s loan diplomacy had finally reached Bulgaria. However, social instability, a succession of early elections, and short-lived and caretaker cabinets interrupted these plans. This is not to say that the ‘Middle Kingdom’ is not finding numerous other forms of economic engagement. In reality, it does, and they are multiplying.

Product Development

The intensifying shift to product development is particularly apparent in the field of agriculture which China has designated as a priority area. The first agreements with Chinese academic institutions in this field date back to 2011. Product development was part of the arrangements between Shanghai Jiao Tong University, the Agricultural University of Plovdiv, and BrightFood Group (Co.). The Chinese Xinfa Group is planning the opening of an agricultural tech park in Bulgaria with a focus on product development. The Institute of Rose in the town of Kazanlak is working with a Chinese firm on oil extraction and new products. The Maize Research Institute in the town of Knezha is cooperating on “advanced breeding and cultivation technologies” with the Heilongjiang Academy of Agricultural Sciences. The Institute of Agriculture in the town of Kyustendil has developed new types of cherries and raspberries which are grown in China. There are plans to set up a separate company for such projects and activities.

Huawei is another company with over a decade of implemented technology and product-oriented engagement in Bulgaria. While their early initiatives focused on scholarships and recruitment, there has been a marked shift focused on wide-ranging activities, including research and product development. For instance, the firm concluded a cooperation agreement with the Technical University in the city of Gabrovo. The university has its own tech park with emphasis on development and modification of new technologies, R&D, data management, etc. The agreement with Huawei explicitly envisages development, scientific research, and project activities. Similar documents have been signed with other universities. The memorandum with Sofia University commits to a joint development of AI and various new industries as well as the creation of a joint AI lab. The establishment of a joint scientific center for research and development is also part of the agreement.

Product Placement

Economic engagement is intensifying markedly in this area. Since 2017, Bulgaria is home to an e-commerce platform of agricultural products aimed at presenting and promoting such produce from the countries of Central and Eastern Europe (CEE). In 2019, a demonstration zone for agricultural products was opened on the premises of the Agricultural University in Plovdiv which functions as “digital product storage” from which Chinese clients can order. There is also a permanent hub for agricultural and other products from CEE at Trakia economic zone which is regularly visited by various Chinese delegations from companies, public authorities, and research organizations. Increasingly, product placement initiatives are focused on specific sectors. For example, in November 2025, numerous Bulgarian firms in the cosmetics industry had a platform to feature their products and find local partners in the Chinese city of Ningbo. Specific events for producers of beverages and food are also becoming more frequent.

A rising number of Bulgarian national and regional trade chambers and their member companies are improving their export and placement knowledge. Some are now offering consultancy, positioning, promotion, and other services for Bulgarian firms wishing to enter the Chinese market, such as the Bulgarian-Chinese Chamber for Industrial Development. With state support, companies from the country can exhibit their products at the permanent expo in Ningbo and create contacts with local traders. Bulgarian firms are also offering direct participation in numerous Chinese trade fairs for interested partners. Notably, a greater number of Chinese institutions are facilitating product placements from the country, such as the China Council for the Promotion of International Trade and international trade exchange offices at the city level, among others. Provincial governments, such as the one of Sichuan, are also providing platforms for exchange and product placement in both directions.

Product Marketing

The business trajectory of a high-end Bulgarian cosmetics and food supplements company, Ecomaat, illustrates the increasing prominence of marketing efforts in relation to the Chinese market. The initial steps to enter this market are done by the Bulgarian founder of the firm and his team. The decisive move comes with the hiring of two business specialists as ambassadors of the brand in China, who later become part owners. The breakthrough comes after 2019 when the positioning of their brands proves a success. The team in China has over 20 employees and hosts two large Ecomaat Brand centers in Shanghai and Chengdu and a spa center, Ecomaat Beauty House. It is expanding its production facilities and enlarging its marketing and development teams. Effective campaigns on TikTok are also part of the marketing toolbox. The company’s products are among the consistently rated on key platforms such as Tmall and Taobao. Ecomaat was recently awarded the prestigious title of ‘2025 Annual Influential Brand’ at the 11th China Beauty Industry Oscar Awards.

The channels for marketing Bulgarian products in China are also multiplying. For instance, the Facebook page, Vitosha Studio, supported by China Radio International, features and promotes the most popular Bulgarian product groups such as rose oil, yogurt, and red wine. The studio does daily posts which at times introduce Bulgarian customs, food habits, and products. At the official level, the Chinese government is presently working to help integrate Bulgarian companies in the largest e-commerce platforms in the country as a vehicle for deepening trade ties. Commercially, the Chinese firm, Bright Dairy, has been marketing its locally produced yogurt with imagery and storylines from the mountainous Rhodope village of Momchilovtsi. The company now sponsors annual yogurt festivals in the village since 2015 and organizes beauty pageants with the photos of winners placed on the labels of the company’s products.

Towards a More Diversified Economic Presence

There are notable other transformations in the wider economic context of China’s economic presence in the country. Great Wall Motor is reopening its assembly plant in northern Bulgaria after it closed down in 2017. Shanghai Unison Aluminum Products has invested in two car parts factories in the industrial heartland around the city of Plovdiv. Chinese car producers are entering en masse the car market. Political support for stronger bilateral relations is also expanding with the entry into government of the socialist party which has long-standing ties to the Chinese communist party. Beijing has routinely expressed interest in sea and airport infrastructure with Chinese conglomerate HNA winning the concession of Plovdiv Airport in 2018 before withdrawing. The present Bulgarian government is implementing an ambitious program of infrastructure modernization which is heavily reliant on concessions and Chinese companies are expected to participate. Sofia’s accession to the eurozone is already impacting positively the strategies of investors from the ‘Middle Kingdom.’

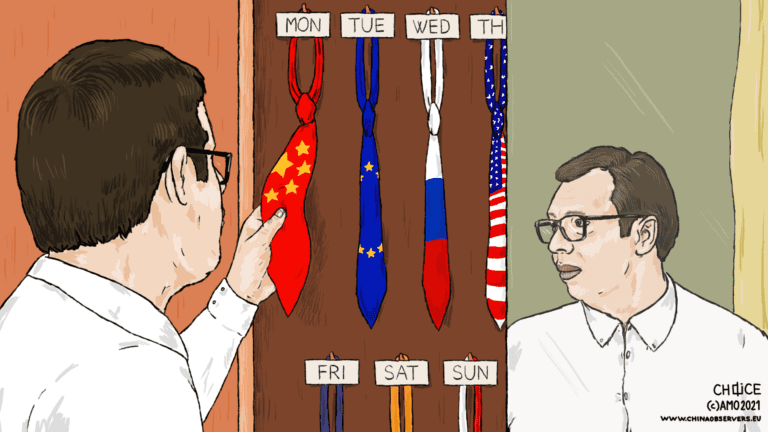

The on-going developments in bilateral economic relations between Bulgaria and China clearly point at a shift away from loan diplomacy toward more diversified sets of engagement. These encompass greenfield investments, product development and placement, cooperation with a wider range of Bulgarian companies, nascent integration in e-commerce platforms, and renewed interest in infrastructure development. This emerging model of economic interaction is quite different from the early attempts of Beijing to position itself by means of a few large-scale, loan-backed projects in key sectors. While its contours are only now taking shape, the potential for the ‘Middle Kingdom’ is already apparent. It is offering a greater range of opportunities for local actors and more realistic and tangible prospects of economic gain. In the case of Bulgaria, China’s emerging economic presence clearly dwarfs that of the EU and the shift in ambition and approach could prove to be quite consequential.

Written by

Vladimir Shopov

Vladimir Shopov is a visiting fellow with the Asia programme at the European Council on Foreign Relations. He is a consultant, researcher and columnist with 20 years of experience and has worked with numerous companies from Austria, Belgium, Germany, Spain, Sweden, UK, US and others. Shopov has also worked with the European Parliament, MEPs, the European Commission, the British Council and many other European and Asian policy and research centres. He was adviser on EU affairs to the minister of home affairs (1997-1998), counsellor at the Bulgarian mission to the EU in Brussels (1998-2001), EU adviser at the British embassy in Sofia (2002-2003) and adviser to the minister of foreign affairs (2014-2017). He is a graduate in political science and comparative politics with MA degrees from Sofia University St. Kliment of Ohrid and the London School of Economics and Political Science. He has also studied in Oxford University, London University (Queen Mary College), New School for Social Research, California State University, Peking University and King’s College London.